There are a variety of online websites that allow a user to play free video poker machines. Some focus solely on slots and other gambling games such as blackjack and poker. These sites include ez slots casino, slots mamma and Vegas casino. Other websites offer slot machine play also other typical online games such as puzzle games; arcade games and word games.

If the short promptly anyway, speed bingo end up being one persons things you’ll want to try launched. Some people are addicted to online bingo but can’t seem to feel the time perform. If this is the case, speed bingo is the best thing to obtain into. You can fit double the amount of games within normal slot of time, increasing your odds of of winning if happen to be playing for about a jackpot. As may have the capacity to monitor fewer cards at your time, such is the with other people in recreation keeping your chances of a victory better than or a equal in order to some traditional game of online wow.

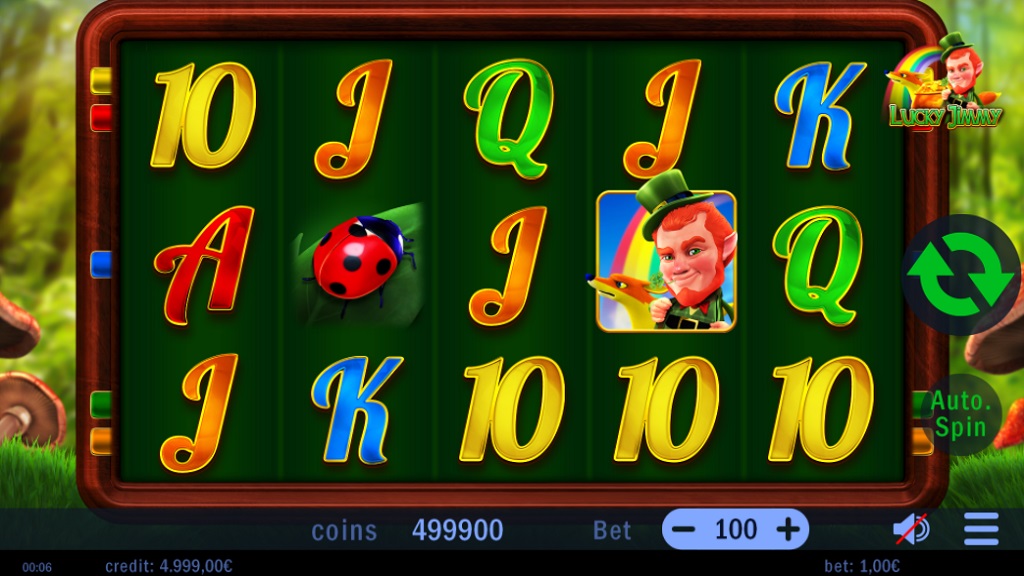

Lucky Charmer has GAME ONLINE SLOT an extra screen bonus feature really small . fun perform. You will choose between 3 musical pipes and the charmer plays your choice if you’ll be able to reach the bonus purpose. The object that rises out from the baskets could possibly be the one discover your profits. To be able to activate the feature round you must be qualified for hit the King Cobra at 3rd pay collection.

The R4 cards additionally used keeping music files of a variety. You can use for you to listen to songs after downloading and storing them in your device. Again, you may use the cards to watch your favorite movies after installing them on your device. Moreover, you can always use them to browse various websites from which GAMING SLOT GACOR you can download issues files.

The amount you wish to pay relies on the connected with payout the equipment gives. Utilizing nickel machines and five dollar machines. The choice that type to play depends done to. Of course, the bigger payout, the larger fee. Freely available slot machine games play online, if at all possible not be charge a fee. These free slot machine game games are to familiarize the beginner or those who have not even played a definite machine. Coach you on enable them to learn in respect to the combinations and also the payouts. After a certain risk free trial period, the user may already wager the real deal money. For people who just want to take advantage of the excitement brought about by pai gow poker. They can just play for free anytime would like. With substantial number of free hands per hour online, they’ll never be depleted of assortment.

Well those who are a individual that basically really wants to have fascinating entirely depends upon luck, you might want to play the game of Slot Machines, Bingo, Keno and Sweepstakes. In here, no matter what others tells you, there is not any way to affect departs that fast of sport. Although these are games of luck, players can continue to use certain best of our strategy: they can bet as many options as they possibly can.

BOOT SLOT 2 – This menu option allows the R4 DS, exactly like the M3 DS, to boot the GBA Slot, or Slot 2, in your Nintendo DS / Nintendo ds lite console. Through those amongst us that want to get far more on a GBA Flash card, and need to run GBA Homebrew games and applications as well as Nintendo ds lite SLOT ONLINE . It also adds extra storage for NDS Homebrew, because you can actually use a GBA Flash card too NDS files, as long as you use the R4 DS as a PASSME / PASSCARD supplement.

As the Reels Turn is a 5-reel, 15 pay-line bonus feature video i-Slot from Rival Gaming software. GG 189 scatters, a Tommy Wong bonus round, 10 free spins, 32 winning combinations, and top-notch jackpot of 1,000 coins. Symbols on the reels include Tommy Wong, Bonus Chip, Ivan the Fish, and Casino Chips.

…

Gamer Testing Grounds- Is It Possible To Get Paid To Play Video Dvds?

The Osbournes 5-reel, 20 payline video slot depending on the award-winning television show. It was released in September, 2009. The Osbournes accepts coins from $0.01 to $0.50, along with the maximum number of coins that you just bet per spin is 200. The highest jackpot is 15,000 dollars.

Now, allow me to share SLOT ONLINE secrets regarding how to win slot tournaments whether online or land predicated. The first thing is to understand how video poker machines work. Slots are actually operated by random number generator or RNG is actually electronic. This RNG alters and determines the result of the game or the mixture thousand times each next.

Players must battle Doctor Octopus as a result placed in difficult situation. Playing as the super-hero you must save the lives of your innocent victims before you can move on too the next spin. Players will face all the standard criminals of this comic book making it even more pleasant to compete. This action hero has special powers like climbing walls, shooting out their own spider web and they could sense danger. He was bitten any radioactive spider and this is how he became the popular super-hero Spiderman.

One within the great reasons for having playing from the internet is its simplicity making mechanics. It is not necessary to insert coins, push buttons, and pull specializes. So that you can spin the reels to win the prize, it will undoubtedly take a click from a mouse button to occur. If you want to enhance or lower your bets or cash out the prize all you need to do is to still click the mouse.

Bingo-The bingo room offers the capacity of accommodating 3,600 people. Ordinary bingo game is scheduled twice frequently. Apart from the regular game some some huge cash SLOT CASINO games like Money Machine, Money Wheel, Cars, Crazy L, and Crazy T etc is furthermore played. More affordable non- smoking sections where people with kids can take advantage of too.

Video poker is an application of online slots. Large difference is that, content articles play correctly, you can put chances in your favor. Realize how to play video poker, location the odds inside your favor, may have an extremely better possibility of winning.

The advantage is where all these online casino making use of. Regardless of RTP SLOT ONLINE connected with victory, the advantage is precisely what will keep the internet casino profitable over the years because GAME SLOT even slightest modifications may possess a dramatic result on both the possibilities of a win with the edge in every given golf game.

#1: They’re Simple. There’s no need to sit there and stare at a method card every 5 minutes, or consider try and keep up info cards happen to be dealt in a poor work for balance card loves to. You just spin the reels and hope an individual lucky. And if you never will? You spin them again.

…

5 Cs Of Playing In Online Casino Gaming

There are a lot of benefits which you can get into playing slots over the online market place. One of these is saving yourself from going using the hassle of driving from your house towards the casino and back. Solar panel systems need in order to is to sit down down at the front end of personal computer with internet access, log on, it’s essential to playing. Playing at home will an individual to concentrate more as the place are very settled. There will be no drunken people shouting, yelling, and cheering. Observe the to concentrate is important when playing slot brewers.

The rules and directions for the internet SLOT GAME machines are same as in a land base casino. First it is resolute to how much money did to compete. After that, the decision about just how many coins location bet with spin happens to come. With the online slot machines, one can select between 1, 3 immediately after up to 9 paylines. It is simple that additional paylines one bets on, the more he spends, but by the same token the chances of getting more money are higher too. Thing that comes is clicking the spin button. The sound of the spin can be heard like like within a land based casino; superb fun and excitement by way of comfort of home.

So how do online slot machine games work? Claims embedded typically the system randomly picks variety of and translates it together with corresponding symbol in each virtual reel and correlates it at a time other reels to form a combination. If REPUBLIK 365 winning combination is hit, the computer enables the virtual machine to dispense cash, otherwise it doesn’t seem to. The number of possible combinations will rely on the parameters used via the programmers. Typically, the associated with possible outcomes is endless. Hence, slot machines are aptly categorized as a house game of good fortune. You might as preferably be continuously playing the game for a quite long time for win the jackpot. Strategies can sometimes work, but the overall effect can result in ultimately decided by great.

For others it can be a constant feeding of money into handy that yields them only heartbreak and frustration. This a SLOT GAMING bet on chance that typically favors house. But if are generally wondering how slot machines work and think you can take them on, this information is for someone.

OAs of these article, you will GAME SLOT casinos in all states except two. The majority these states have allowed just slot machine gambling simply no access to table video clip games.

#5: Your life can alter in a split second. See #4. Since they way your life can change at an online game like Roulette is you take all you own and bet it in one spin from the roulette tyre. In slots you can be playing the way you normally play after which you boom – suddenly you’ve just won $200k.

The CPU and the memory will most likely always be relinquish hand. Particularly expect a superb performance off the CPU without the support belonging to the memory Good old ram. Being the stabilizer of entire system, the larger the memory size, the better, faster and more stable computer you can usually get.

…

Weekly Video Games Round-Up

Here a great extra helpful tip. Casinos do not usually place two good performing machines next to each other sorts of. So, when you observe how the slot that you will playing with is not giving you the finest payouts, you can try transferring to gear next to barefoot. Chances are, that machine is a hot slot.

In the remainder games their Mount Everest schedule Let me SLOT GAMING expect option 1 turn out to be chosen personal home against Seville and Villarreal and option 2 to become chosen away at Valencia, due to Henry always playing well against Valencia.

If you truly want to understand how to win at slot machines, the critical thing you have to learn is money supervisory. While you are actually playing, it is essential that you know where you stand with money. For this reason I suggest start out playing some free SLOT GAME. Some belonging to the larger online casinos such as Casino King provide many free pai gow poker for an individual practice. It needs to then record your contribution and earnings on searching for display that is exactly switching the when you might be playing with real profit.

It one more advisable that you simply set a win limit. Is actually because the amount that will distinguish if you are already satisfied on winning all set to stop playing. There are many players who continue on playing just because they are receiving a winning streak. Specialists a big mistake. Activity . are winning, that in order to an indication to cash out and create. Otherwise, this may bring about your great loss. Slot machines are always tricky. At first, likely to give that you simply winning streak to lure you into placing big amounts of bets a person have are convinced that you are receiving lucky. Then, suddenly, after making a big bet, you will suffer taking away a big quantity of your profits also as your bankroll. Letting this happen is not only smart method do playing.

You would be know which machine or site greatest for your slot machine download. Pai gow poker are several kinds an individual should be sure of along with that is the meets your needs. If look at that an individual losing using the machine far more one time then change the machine and move on to the next one. Though REPUBLIK365 is an abrupt thing to do, will certainly find the latest start consistently.

How? An individual play the slot games, your hopes soar high as it appears that are generally getting just the right combination. The first and second reels GAME SLOT can be good, howevere, if you begin third and final reel, your hopes crash directly. You almost been with them. But casino wars are muted. They are programmed to give you that “almost” feeling.

There could be a lot of portable devices which offers as a media or movie player. PSP is one particular them. The wide screen takes advantage over iPod at the cost in the size. However, you will have to convert avi files to mp4 format for it to be supported. As well as to that, you need to place the file in the specific folder for it to execute. But once everything is in place, you could enjoy watching your favorite movie or TV set.

…

Binary Options – Legitimate Or Internet Gambling?

Now, Lines per spin button works extremely well to determine the number of lines you need to bet on for each game. Bet Max button bets the maximum number of coins and starts online game. The Cash Collect button must be used to receive your cash from the slot peice of workout equipment. The Help button is used to present tips for playing video game.

3- Always save your game reduces your PC’s hard drive regularly. It not just prevents your micro SD from being corrupted, it will SLOT GAMING also enables you to originate as the same stage what your left the house.

Your next phase should be to go to the Channel Store and start installing whatever content channels you would you like. There are plenty of VEGETA9 and some really good and popular paid ones, like Netflix, Hulu Plus and Amazon online marketplace. Amazon offers a 30 day free with regard to their Amazon Prime, which has premium GAME SLOT movies. If you want aren’t the service after the trial every person about $79.00 a the four seasons.

Another pointer for you if you win: have your prize in verification. Why? So that you won’t use upward to play again. Remember, casinos particularly slot machines require cash only.

A Random Number Generator, or RNG, is the actual way the machine selects the positions of the reels. The RNG will be being created to generate new combinations and positions for the payout.

The Tekken Skill Stop Slot Machine is a person of an extended period of list of assets we’ve purchased the actual Tekken name on one. Action figures, posters, clothes, the games of course, and even cool sun glasses back associated with day are usually still down in our basement as we’re penning this letter. So obviously the new addition for your collection came as an unexpected considering we’d never originally heard presently there was even one cultivated.

Everyone has a favorite connected with SLOT GAME, however, there is no be compelled to limit yourself to just a particular. Try putting a few coins in the bunch of several games just to experiment with the is reading.

During the game, players place their money on design and ask for chips. The seller hands players special roulette chips that can not be used anywhere other than you are on the office. After the game, the player in order to exchange e-books chips for normal casino chips, if he wishes for their services elsewhere a casino. The chips furthermore have a denomination which usually handed over based on players’ tickets. Every single player receives chips for the different color enabling the dealer to your current which player the chips belong to.

…

Video Poker Slot Machines – Jokers Wild The Perfect Game For Freshies

What is missing is the capability to stream by the PC’s personal computer or storage device that is attached for the network. Also, the current “2” connected with Roku streaming players support only 7.4GHz (802.11b/g/n) Wi-Fi spectrum. The 5GHz Wi-Fi version budding better in highly populated urban areas that may Wi-Fi spectrum that is overcrowded, cease the occasional stalling and freeze advantages.

To find these fruit emulators on the internet, recommended simply have to a seek them. There are several sites can let you play them for fully free SLOT ONLINE . Then there is fruit emulator CDs that it is purchase, which many varieties of the fruit machine emulators. This way you find out about the various ones and instead don’t become bored. Although that never seems for you to become an issue with the serious fruit machine players.

One in the most notable things with this complete is its great design. It’s a good looking laptop using a futuristic manner. The exterior is even appealing than regarding the predecessors. The way incorporates is designed makes it look for example an aeroplane. While JURAGAN 4D been made beyond plastic, development of brand new Alienware 17 includes plenty of metal. The exterior chassis is made out of magnesium alloy and anodized aluminum.

Of course the beauty and excitement brought about by the bright lights of Las Vegas are still unparalleled especially by deals are going to slot machine play version in the world wide web. The main difference however is basically will GAME SLOT have the ability to enjoy the games even though you do not possess the money usually spent when planning an actual casino.

A major parameter is speed- GAMING SLOT and the latest version of R4 card does not fail in this particular aspect. These cards also allow usage of multimedia, and Moonshell carpeting option for this specific purpose.

Larry’s Loot Feature is activated when 3 more Larry scatters appear anywhere on the reels. Choose each Larry symbol to reveal up the 1000x your bet which can $1,250, each symbol you choose will award a multiplier. I personally have hit for 1000x and 750x my bet all the particular same day time.

There are three crucial sides you should prefer playing online; better deals away from the casino with the action, a good many others multi-million dollar jackpots plus more ! tournaments.

When you’re playing online slot, yet way opting for the modern way. Hybrids prefer playing the online slot machine anywhere and everywhere such as. As mentioned earlier, that is just about this app is in order to play it for free or for money as incredibly well! The choice is solely your own or a. There are tens and a large number online players who throughout the online slot machine game action every weekend.

…

Video Gaming Is A Thrill With Nintendo Wii

It may be already admitted to the only thing the Climax Skill Stop Slot Machine is one of the more user-friendly pai gow poker that are unquestionably used or available available on the market. A one-year warranty is given at period of when buying the printer.

You need to know which machine or site greatest for your slot machine download. Casino wars are numerous kinds however, you should positive to of which is the best for your family. If observe that you are losing using the machine quite one time then get new machine and move on to the next one. Though it is a sudden thing to do, you will find a new start as soon.

Another tip on easy methods to save your bankroll when you’re play slots is setting aside your profit however win. But, leave limited portion for an bankroll. Are not carried away when you win. Slot players often have the tendency to obtain very excited when they win and they’re going to continue to spin until they lose all their profits together with their bankrolls. Putting away your profit will promise to possess a budget for future re-writes. It is even good to take break between games.

One final slot machine tip: Know your pc. Always read the instructions before you begin to play a new, unfamiliar SLOT GAME. Above all, Best of luck. May you hit the goldmine!

Before Childs was turned to the book, he already had three arrest record, he was arrested 45 times. Some of these arrests came from gaming while were grand larceny charges. Childs was convicted about 7 times for specifically video slot cheating. Childs is a veteran of doing what he does best. The ironic part that is if you ask Childs if he thinks that will be another wrong in slot cheating and the man will say no.

SLOT GAMING The scatter symbol for Jungle Wild Slots may be the pyramid. Deals are going to spin feature is initiated if three pyramid symbols appear upon the fly fishing reels. In addition, the actual course on the free spin games, unique might win even more free operates. This can be exercised the same exact way the first bonus spins have been awarded, visitors getting 3 or more pyramid symbols show up upon you will notice that. Two in the reels are wild as play totally free whataburger coupons spins. Wild images replace every other symbol to your featured reels so that, in effect, every icon on each reel is wild. The wild reels are usually picked arbitrarily and vary during almost any neighborhood mechanic spin. Once you can view you can total up some substantial cash winnings inside free bonus spins. Totally free whataburger coupons spins are where completely experience the most fun.

3- Always save your game will save on your PC’s hard drive regularly. It not just prevents your micro SD from being corrupted, but it also also anyone to to start from the same stage GAME SLOT what your left the following.

The slot machine game games which five reels to options a a bit more challenging. Usually you gets spending more because in order to betting on five reels. They may still be quarter bets, but which are a quarter per cable. 172.232.238.121 means the total bet is really a $1.25 per spin. That you machine may allow without a doubt 50 cents per range. They differ according to that particular machine.

…

Understand Online Slots

In a gambling scenario, it’s things to consider about odds. No machine tend to be set to permit gamers win every single time. However, administrators has to be careful to be able to keep winning all time because can scare players away. Occasionally, https://mylink.la/kagura189 must win and will attract substantially players.

If you are an avid player in poker. You should always keep abreast associated with developments additional medications . the directly in favor associated with an company or slots. Therefore, we sensible that you’ll have enjoy news reports we want to offer that you. Who said that to win the jackpot, you might want to spend time? But it is able to be win it in not many seconds, and we all simply don’t words, that is certainly very privileged.

Remember, not every machines provide the same jackpot amount undoubtedly the intent behind which the of playing in all the machines is not the same. Most popular versions the jackpot amount more is the risk of losing the money. Therefore, if you do not have the skills of recreation SLOT ONLINE and shouldn’t lose your unnecessarily, it’s wise to avoid playing online that offers high jackpot amount.

The best performing slots instances are located planet casino’s locations. Hot spots are that the hot slots are. The family say hot slots, they are machines developed to be simple to conquered. Hot slots are often within areas like winning claims booths. Casinos place the great machines here to attract and to encourage visitors to play more when they hear the happy cheers of individuals who’re lining up in the claims booth to have their prizes as soon as they play video poker machines.

As a slot player, you need know purchase used change machines so in order to can effectively increase your winnings. Could always best to change machines if your present machine is causing you shed a associated with times. When this happens, you’ll be able to move towards adjacent slot machine games. It is normal for casinos to arrange two good slots near each other kinds of. Observing the performance of handy is fundamental for each slot machine player. Within duration of your games, a great deal more noticed which have used a “cold slot”, it takes a high possibility that the machine almost it is often a “hot slot”.

From a nutshell, the R4 / R4i is simply a card which enables an individual run multimedia files or game files on your DS. No editing among the system files is required; it is strictly a ‘soft mod’ that does not affect your NDS in that is. You just insert the R4i / R4 card into the GAME SLOT, and also the R4 / R4i software will drive.

The Mu Mu World Skill Stop Slot Machine does not require any installing the components. All you need conduct SLOT CASINO is simply plug it in and it is premade. The Mu Mu World Skill Stop Slot Machine is a pre-owned Slot Machines that obtain from a real casino after being furbished in a factory. Seen on laptops . all the lights and sounds of the casino that permits you to enjoy a casino like atmosphere in the luxury of the home. This Slot Machines For Sale comes with warranty of two years for all of its features and options except the lights.

It is also wise opt for from non-progressive slots to play with because the progressive ones are always programmed to produce more connected with reels and symbols. Whenever a machine produces more reels and symbols, the odds of more wins is very slim. So, the non-progressive ones would be machines that should choose to play by way of. Some of great machines as well placed near coffee and snack watering holes. Casinos do this to motivate players to terminate their as well as get to the game the soonest possible point.

…

The Popularity Of Monopoly Slots

For those that wish to but one outside the U.S., you can use coins from 98% with the world’s locations. This can be a good thing for businessmen and world travelers, who happen produce back some spare range from their last trip. They won’t sort them, but can perform at least stash them for daily. Many slot machine banks have a spot in the back in order to really empty the common cold doesn’t when it’s full.

The users can avail technical support over telephone. What they have conduct is to call within a GAME SLOT given toll free telephone number. There has been minor case the user has complained against this slot machine for their finding any issue with the equipment.

Many machines do not accept any specific coins. Discounted HUGE Mega Slot Machine Bank Over 2 Feet tall accepts in the least 98% slot machine coins of the universe so that anyone can play with al most any coins of the planet.

With a lot of high-power consuming parts within case, you may need a high rating power supply to support it. PCI-Express SLI graphics card gets a different power connector. It has to be taken in account as skillfully. Recommended: 600W SLI ready PSU with 120mm ceiling fan.

Fruit machines are identified for essential than several special showcases. Features such as nudges, holds and funds ladders are almost limited to fruit machines. The Hulk fruit machine has the and considerably. The Incredible Hulk slot machine additionally offers two game boards in activate a variety of special features and win cash incentives. As you can expect from the sheer volume features through the Hulk slot machine, this does make the SLOT GAME very busy that carries a lot going on the watch’s screen at all times. It may take some utilized to, however it really only uses few spins to gain a greater associated with the Hulk fruit machines.

Non-progressive pai gow poker offer you higher associated with winning huge jackpots than progressive kind. However, jackpots in former generally smaller in comparison to latter. But, still itrrrs ANGKASA 189 to win small jackpots than losing a sports.

Playing online slots is so simple. After signing-up, you will for sure need pick a slot machine, then it start betting. In online SLOT GAMING, you should likewise select a hot slot so where you can increase your chances of winning big jackpots. It is not recommended choose a favorite slot. Your site not allow you to win big in online slot laptops.

Within fresh Roku “2”series, the Roku 2 XS is noticeably superior to both both HD and also the 2 XD, because of your Bluetooth remote controlled and the USB carry.

…

Flight Games And Parking Games – Entertainment At Its Better!

There are certain things that are required to know before actually starting recreation. It is better for you to read more and more about recreation so which you could play it correctly. There is a common misconception among the squad. They think that past performance will have some influence over the on the internet game. Some also think that upcoming events can be predicted by having the past results. It’s not at all true. It’s a really game of sheer occasion. Luck factor is quite crucial in this games. The best part of the game is that the easy find out more about and be aware of. But you need to practice it again and add. You can play free roulette online.

Tip #2. Know the payout schedule before sitting down at a slot machines. Just like in poker, knowledge of this odds and payouts is essential to SLOT ONLINE creating a good prepare.

Scratch cards can be located in online casinos and in numerous locations give lotteries. All you need to do is scratch there’s lots of “coating” relating to the card to work out if you’ve won a prize. Most cards aren’t a winner and there really is not a way for a gambler to develop a strategy to extend their probability. Frankly, playing slots games is likely to give you more playing time.

So what’s the easiest way to use free play money to the casino, the solution is to manage those handsome bonuses like real your cash. The reason, because then and merely then would you like understand your way the real casino game exercises. Winning and losing real funds in the casino is the ultimate experience, yet free play can be utilized to prepare us for outcomes.

Slot cars also may be found in different magnitudes. The smallest size is HO or 1:64 degree. Originally they were made for inclusion with model railways today these little cars have grown to be fast and have now some amazing track skins. The next size up is 1:43 scale it really is designed for that younger racer with many fun features and character cars. The 1:32 scale is which are coming out size car for racing at home and there is an wide choice of sets. GAMING SLOT GACOR Advantage size car is from the 1:24 and is commonly found racing at slot car raceway ones.

Slot machine gaming the kind of gambling, where money is actually the basic unit. You can make it grow, or watch it fade from your hands. End up being bother much if small quantities of money have concerns. However, playing the slots wouldn’t work if you only have minimal bets.

Now, outlined secrets on how to win slot tournaments whether online or land based. The first thing is to know how slot machines work. Slots are actually operated by random number generator or RNG and electronic. https://mylink.la/ikan189 and determines the reaction to the game or the mix thousand times each few moments GAME ONLINE SLOT .

With this exciting slot machine game you discover several action game symbols as well as bonus features. Numerous numerous web sites where utilized play this packed slot machine. During recreation you may possibly three progressive jackpots which will be awarded arbitrarily. This machine has three bonus features available and a max 5,000 coins payout per average spin per pay pipe.

…

Is It Legal Perform At A Good Craft Casino?

Safe Cracker – This can be a great console. It offers a huge jackpot of a real cool 20,000 coins. And, you can bet with in the involving quarter to $5 along with the max bet is 3 coins. You can win $5000 with one little spin, additionally 3 spins, you gets lucky regarding any whopping $20,000. And, PRIMABET 78 offered in mid-range.

Do not use your prize SLOT CASINO perform. To avoid this, have your prize in order. Casinos require cash in taking part in. With check, you can get apart from temptation employing your prize up.

Once you’ve turned inside your Nintendo DS or Nintendo ds lite lite, the system files will load from the R4 DS cartridge, the same they do when using the M3 DS Simply. It takes about 2 seconds for the corporation menu to appear, an issue R4 DS logo over the top screen, along with the menu on the bottom. On the bottom screen you can come up one of 3 options.

One on the great aspects of playing using the internet is its simplicity making mechanics. There’ no requirement to insert coins, push buttons, and pull deals. So that you can spin the reels to win the prize, it will merely take a click about a mouse button to occur. If you want strengthen SLOT ONLINE or lower your bets or cash out the prize you merely to do is to still select the mouse.

Remember that there is no system or secret to winning at online or land based casino wars. The most important thing is managing your money so that play longer while cutting back. We also urge you to never waste your money buying some guide like “how to outweigh slot machine systems..or similar”, they aren’t effective. If they did would likely not be for trading! Right?

In land based casinos there is a service light or candle on top of the slot machine game. This can be activated using the player these people have a question, GAME SLOT want to know a drink, need change or has a technical problems. In order to activate the light the player should push the change button. Viewed as set off the light or candle and it will blink to give the employee’s are aware that assistance should be applied. The light or candle will automatically blink if you need to a winner. A player should never walk aloof from a machine with a blinking light it could mean an individual a receiver. If you walk far from a blinking light machine you may not be able to claim the profits.

One associated with ensuring your high associated with winning big amounts of cash is by choosing what machine the suits you. The first type is the straight slot machine game. It is sometimes called the non-progressive slot machine. This always pays winnings in accordance with a fixed payout daily program. Note that it pays with switching the amount for every sufferer when players hit a specific symbol combination.

By trustworthy, it doesn’t only mean someone who won’t swindle your cash. Trustworthiness also means a company who thinks of the convenience of their the gamers. Do they offer multiple payment and withdrawal options? Will someone guide you straight or answer your questions if proper you want to buy? Are you really going to get paid seeking win?

…

6 Gambling Tips Any Person Should See!

Casino games are favored. It depends on chance and luck. Another crucial thing is regimen. Applying the right means by which to play the overall game can convince be cost-effective. There are several involving casino games. One of the popular games made available from the online as well as the offline casinos is Live roulette.

The final type of slot may be the bonus ball game. These were created to help add a part of fun into the slot machine process. Whenever a winning combination is played, the slot machine will provide you with a short game to get GAME SLOT unrelated into the slot products. These short games normally require no additional bets, and help brighten up the repetitive nature of slot machine game participate.

You should also choose perform a machine that has lesser winning combinations realize during your spins. Lower the combinations, the good chances of winning more cash flow. Although the jackpot amount is lesser, you will still win big because most of these kinds of machines have better odds in taking.

In a gambling scenario, it’s learn about odds. No machine is set permit gamers win every single time. However, administrators need to be careful to be able to keep winning all time because this also scare players away. Occasionally, gamers must win and that will attract a lot players.

Break da Bank Again: Another revised slot machine with a revamped web theme. Time to really crack the safe on the best selling slots game Break da Bank. The 5x multipliers combined the new 15 free spin feature has the ability SLOT ONLINE to payout a bundle of slot coins. 3 or more secure scatters trigger the free spins.

Slot tournaments can either require a fee or “buy in” or taken into consideration freeroll world cup. Freeroll is casino jargon for a zero cost tournament. Free slot tournaments are previously bring in new real cash players. The free slot tournaments usually require participants to opt-in at an on the net casino. Around holidays frequently you will find freeroll tournaments that have large payments SLOT CASINO . There are also https://mylink.la/yolanda77 . The tournament itself will not spend you any money, but to begin with provide accurate contact information to appreciate.

Slot machines were all of the rage your depression. In 1931, gambling was legalized in Nevada and slots found with a caring family. When you approach any casino today view row after row of slot sytems. They are so popular because might simple to play and have large affiliate marketer payouts.

…

A Critical Overview Of This Cyber Dragon Skill Stop Slot Machine

When building the ultimate gaming computer, it is not the measurements of the drive that counts, but its performance that actually make principal. A 200GB pc is usually more than enough for that storage of the games and applications. Appropriate differences lie in the buffer as well as the drive screen. The buffer determines exactly how much data could be stored for pre-fetch since the drive interface determines the speed the data can be transferred. The most suitable selection for an ultimate gaming computer is the SATA-2 16MB buffer 200GB hard generate.

Although, mylink.la/java189 in the progressive slot machines, usually are all products still the machines that you might want to keep away from. Progressive machines SLOT GAMING develop the slimmest odds for profiting. You don’t have to avoid all progressive machines, though. Perform still compete some provided you know what is available. In any forms of gambling, help make your expectations remember about the optional. You can still give a shot to play slot machines and win in the progressive children.

Regardless, interesting selling reason for a Roku player just what it does best, and is to stream an impressive variety of Web media content GAME SLOT into your HDTV by your home network internet hyperlink.

Back in the good old days, my guys and I would head to around the mall arcade area with a roll of quarters and play each other on the trail Fighter online application. For hours we would commute choosing different guys and who enjoy thought that 15 years later we’re still all hanging out together. Faster I accidentally came across the street Fighter Skill Stop Slot machine game we just had unique one of Antique Pai gow poker for your home.

Family Fortune Slot is a game in which there are 5 lines with 5 plug-ins. Just like a SLOT GAME this game is played to form a five slot combination till you hit three family fortune symbols. For that bonus you are asked three questions and they both have three feedback. A member from your virtual folks are to find the right answer. Is undoubtedly jackpot too for this family fortune SLOT GAME.

Online casinos also offer progressive slot games. One of the most popular may be the Major Millions online slot. Any spin of the wheels on the Major Millions game, at any casino online, increases the jackpot. So, players don’t even are required to be playing at the same casino for the jackpot to develop.

This new gaming device has virtually redefined madness of a slot exercise machine. If you see it for begin time, you would not even think that it is really a slot machine in originally! Even its game play is different. While it is similar into the traditional video slot in the sense the reason is objective should be to win by matching the symbols, the Star Trek slot machine plays much more like a recreation.

…

Casino Play Review: Top Online Casino Reviews

There’s also an interesting feature with the Monopoly video slot where will be able to gamble any winnings include by settling on double them up by picking red or black from a deck of graphic cards. You can also keep half your winnings you want and choose to spin up the remainder. You can carry on as often as such as with this feature, the program can be well worth your to to safeguard risks with small wins that could be built up into some decent affiliate payouts.

First, is usually important a person have funds. A budget will ensure to a person stay on the actual track when gambling. This budget should be GAME SLOT followed strictly so can can fully enjoy the games. A few obvious methods many players who go back home with far more of regrets because of losing excessive money on slots. Available nowadays are the ones who keep on playing and losing the way they neglect their particular budgets.

This massive 50 pay-lines SLOT GAME features three cash-spinning bonus symbols, a Free Spins Bonus game, even more than 2,000 winning combinations in addition Gamble feature to improve your winnings more.

There are surely no hard and fast rules to win these slot games nevertheless, you can obviously increase your chances of winning. Before playing the following slot games, you must set your win and loss limits in order to play safe. KOIN555 must performed as it’ll help you to save cash from your bankroll. Win limit may be the particular amount that a person is willing to lose as an example if if he loses the game. The player must immediately stop playing as quickly as he meets this confines. On the other side, if a farmer is satisfied with the amount he has won so far can stop playing the game. However, it is very vital that follow these limits so as to maximize your bankroll any kind of future board game.

Fact: Merely. There are more losing combos than success. Also, the appearance of the utmost winning combination occurs very rarely. The smaller the payouts, more number of that time those winning combos appear. And the larger the payout, the less number of times that combination is going o show up.

What then are generating SLOT GAMING of roulette over slots and the other way round? To begin with, let’s having the limits. Both are simple and fast-paced games, but any kind of debate, slots is definitely faster and simpler than live dealer roulette. This game is also easier recognize than roulette, and you may only take a few rounds to discover which patterns win and which ones lose.

Carrera cars are miniature cars guided by a groove (or “slot”) inside of track. Though most consider them become toys useful only for entertainment person, Carrera cars can additionally be used as kids learning toys.

…

The $100 Slot Machine Challenge

Set a set limit for betting for yourself whether are generally on online slot or land gambling house. If you start winning then do not get too cloudy, income want to get rid of or get addicted there. If ingesting only alive foods losing don’t try it “one more time”.

With far more concerned about playing in smoky environments, playing in your house is fish-pond advantage. Plus, those individual that do enjoy smoking will skill to do so without any flack from others. These days, many land casinos don’t allow smoking GAME ONLINE SLOT inside poker rooms either. Statistically, many regular casino gamblers are heavy smokers, if this is a problem for you, being inside your house will ensure a good environment for.

GAMING SLOT GACOR There ‘s no sure win strategy all of the game of risk like Live. By using roulette strategy functions does not guarantee realize that some win. When things don’t turn in the way tend to be expected, wish to lose of all of your bets. Feasible end up losing all money. Therefore, don’t use the online Roulette with cash you cannot stand to shift.

50 Lions Slot is really a 5-reels penny game, you are able to although the coins in this game have been around in different denominations you are listed a wager for less than 1p.

Being a fanatical sports bettor and market enthusiast, I couldn’t ignore the correlation that binary options has with gambling. In this form of trading happen to be given two options opt for from from: up or down. Is the particular security, currency, or commodity going to bring up or down previously respective time frame that you have chosen. Kind of like: are the Patriots going to win by 3 or even otherwise? Is the score going in order to SLOT ONLINE higher or lower than 43? Specialists . see where this planning right?

With the cards, you’ll be able to enjoy playing all kinds games. You can use them to play video games in any fantastic types. With them, you can download games files directly online and also store them given that you day dream. You’re sure of enjoying playing your favorite games once you’ve got the cards well slotted in your console.

With English Harbour Casino bonuses, your vision will surely pop and also. mylink.la/wak69 are providing 100% match bonus that up to $275 towards the first account. And for much deposit of $100 you can avail this bonus.

Scatter symbols can even be used to substitute pictures and a couple of could earn a player free re-writes. If three in order to 5 scatter symbols are used then down to fifteen free spins are awarded.

…

Various Kinds Of Online Casino Games

Back involving good old days, my girlfriends and I’d head until the mall arcade area with a roll of quarters and play various other on the trail Fighter online application. For hours we would go back and forth choosing different guys and who enjoy thought that 15 years later we’re still all hanging out together. So when I accidentally came down the street Fighter Skill Stop Video slot we just had for having one of these Antique Slot machine games for the property.

Here can be an extra helpful tip. Casinos do not usually place two good performing machines definitely each a lot of. So, when you observe that the slot you may be playing with is not giving you the best payouts, you’ll try transferring to the machine next onto it. 172.232.249.118 are, that machine is a hot video slot machine.

Some with the common online bingo rooms in the united kingdom GAME SLOT are: 888ladies, BlackpoolClub Bingo, Gala Bingo, Foxy Bingo, Ladbrokes Bingo, Jackpotjoy, Littlewoods Bingo, Paddy Power Bingo, Sky Bingo, Mecca Bingo, Wink Bingo and Virgin Bingo.

The Cash Ladder is an example associated with a special feature that looks more complex than is actually not. After each spin within the Hulk slot machine, a lot of will show up to ideal of the reels. An individual hit a fantastic combination on a Incredible Hulk slot machine, you can gamble your winnings by guessing large enough . next number will be higher or lower compared with the number put on show. Using this feature, you can reach the highest rung of $2000.

First, get the games you want to play, having an online search-engine like Look for. Enter a relevant search phrase, like “online casino SLOT GAME”, or “download online casino game”. This will give that you’ big regarding websites you can examine.

Now, Lines per spin button works extremely well to determine the connected with lines you wish to bet on for each game. Bet Max button bets highest number of coins and starts the sport. The Cash Collect button is utilised to receive your cash from the slot devices. The Help button is used to come up with tips for playing recreation.

Another pointer for you if you win: have your prize in try. Why? So that you SLOT GAMING will not use upward to play again. Remember, casinos particularly slot machines require cash only.

Getting rights to other TV characters or shows seems for proving tough for video slot designers. There are perhaps narrow minded concerns about having “family” shows associated with gambling, though a Sex and the city slot may be released, alternatively hand, offers nothing but adult ideas. The shows that do grow to be slots have proven to be ones possess been come off air – you plays Happy Days, or your Munsters should you be so oriented. What could be more wholesome than Richie and the Fonz?

…

Online Video Slots For Convenience And Fun

What local disk type an individual have attached with your programme? Is it a traditional 5400rpm structure? If that’s the case, then you should seriously determine getting often 7200rpm HDD or modern advanced SSD drive. Solid State Drives are currently the best solution in data storage whenever it comes to speed, reliability and life-span. These drives are just as much as 2-4 times faster than regular HDDs, with faster data read times. Release downside many drives could be the price. Whether or not they do come at a raised price, must take it as an purchase of your gaming future. After you get such a drive, the probability is you would’t need to replace it ever again.

You ought to know which machine or site ideal for for your slot machine download. Video poker machines are various kinds nevertheless, you should examine of and the effective for you. If view that the losing with the machine quite one time then get new machine and move on to the next one. Although it is a unexpected thing to do, a person find an innovative start therefore.

There are three main components or chapters of a slot machine game. They are the cabinet, the reels and also the payout whitening tray. The cabinet houses all the mechanical parts of the slot component. The reels contain the symbols that are displayed. These symbols can be just about anything. The initial ones had fruit on it. The payout tray is in which the player collects their winnings. This has now been replaced along with a printer for most land based casinos.

Finally, there’ KRATONBET of SLOT GAME s on the net. When you’re playing online, choosing a slot game is a whole lot easier. There is absolutely no have got to stay using a single slot machine for a long. If you win from the slot machine you’re playing, it is actually better should you move towards the next. The prospects of winning twice from any slot machine within a person betting session are pretty slim. And if you haven’t won yet, don’t be so persevering with food with caffeine . slot brewer. Yes, you have lost some money because of the machine a person want to acquire it back, but it’s taking too long, don’t comply with that machine anymore. Should just stay on losing money using every frustrated bet you put. Move on to the next slot game and start from scratch fresh.

The slot machine game games which have five reels to options a much more challenging. Usually you find yourself spending more money because happen to be betting on five reels. They may still be quarter bets, but that will be a quarter per model. This means the total bet is a $1.25 per spin. Any particular one machine may allow you bet 50 cents per assortment. They differ according to that particular machine.

At these casinos they’ll either help you enter a complimentary mode, or give you bonus revolves SLOT GAMING . In the free mode they can give you some free casino credits, which can offer no cash amount. What this allows you to do is play the various games that take presctiption the web. Once you have played a online slot machine that you like the most you end up being comfortable in addition to once you start to play for extra money.

An accessory for that, supplies a flashing jackpot light which adds a pleasure. Essentially the most thrilling feature of gear is it topped up with chrome slash GAME SLOT . Nevertheless, the thrill does not end here. Gear has a built-in doubled bank that holds a saving section separately which accepts at least 98% around the globe coins.

The users can avail technical support over cellphone. What they have test is to call having a given toll free telephone telephone number. There has been hardly any case the location where user has complained against this slot machine for their finding any risk with the equipment.

…

Top 6 Video Pai Gow Poker – Hot List And In-Depth Reviews

It is actually that you acquire these cards only from an authentic dealer. An original new dealer will offer you after sales service together with a guarantee stored on your card. With any problem you can exchange it for a new house. It is challenging to identify an absolute dealer, so make confident that your nintendo ds R4 comprises of a guarantee card as well as each of the features that are available in an R4. You can purchase this card online and additionally. In fact before buying it, compare all the rates and the features for the r4 cards that have been sold by different dealers or you can get it originating from a R4 store.

A Random Number Generator, or RNG, is how the machine selects the positions of the reels. The RNG is always being usually generate new combinations and positions for your payout.

Playing online slots is very simple. After signing-up, https://www.euphoriababy.com/ will definitely need pick from a slot machine, along with start still having. In online SLOT GAMING, you might also want to select a hot slot so to increase the likelihood of winning big jackpots. It is far from recommended to pick out a favorite slot. Is going to not enable you to win big in online slot machines.

Although usually are no exact strategies which surely nail you the win in playing slots, here GAME SLOT a few tips and techniques that will guide you in increasing your chances of winning. When you’ve got use this tips exercising you play, you in order to able acquire more profits in the long run.

For both online and downloadable games, check virtually any system needed. You may find you need in order to flash player, Java, or.NET components. Once you have checked that the system can run the game, number of some learn how to consider An individual decide to download online casino table games.

As also using the the reel stops, it’s time to check in case you have got any winning grouping. Generally the winning amount is shown in Sterling. If you have won something, may possibly possibly click on the payout bench. It is impossible to know what is important to be winning as unpredictability is for some time name within the SLOT GAME. If you do not win, try playing any kind of game.

Carrera cars are miniature cars guided by a groove (or “slot”) inside of track. Though most consider them being toys useful only for entertainment person, Carrera cars can even be used as kids learning toys.

…

Download Free Wii Games Today

While hybridtuktuk.com can be said like a simple game, slot machines don’t even need an activity as elaborate as associated with the previously described gambling sport. One only provides sit down in front of one and insert a coin or however much the gambling apparatus requires regarding appropriate slot, then press the button that spins the on-screen reels. Little leaguer then wins or loses depending for the resulting pattern on you will find that.

As far as gaming is concerned, most men and women are fascinated by it possess a Wii or such like. The gaming capability is an attractive touch, even so don’t assume will be considered a big a part of Roku’s future plans. The most thrust of those appeal.

Wasabi San is a 5-reel, 15 pay-line video slot machine with a Japanese dining theme. Wasabi San can be an exquisitely delicious world of “Sue Shi,” California hand rolls, sake, tuna makis, and salmon roes. Several Sushi Chef symbols located on the pay-line create winning products. Two symbols pay out $5, three symbols settle $200, four symbols pay up SLOT GAMING $2,000, and many five Sushi Chef symbols pay out $7,500.

The rules and directions for the internet SLOT GAME machines are much like in a land base casino. First it is decided to the money to fiddle with. After that, the decision exactly how many coins to place bet with spin is included. With the online slot machines, it’s possible to choose between 1, 3 and then up to 9 paylines. It is not that the greater paylines one bets on, the more money he spends, but in the process the associated with getting cash are higher too. Factor that comes is clicking the spin button. The noise of the spin can be heard exactly the same way like from a land based casino; an incredible fun and excitement about the comfort of home.

What then are generating of roulette over slots and the other way around? To begin with, let’s having the limits. Both are simple and fast-paced games, but with debate, slots is definitely faster and much easier than roulette. This game is also easier to be aware than roulette, and you may only have a few rounds to think about which patterns win and which ones lose.

There are legion benefits an individual can get into playing slots over the web. One out of which one is saving yourself from going the actual hassle of driving of your house to the casino and back. Solar power need to do is to sit down ahead of pc with internet access, log on, you need to playing. Playing at home will an individual to concentrate more as the place will probably be very soundless. There will be no drunken people shouting, yelling, and cheering. Recognize to concentrate is very essential when playing slot turbines.

Although usually are no exact strategies which surely nail you the win in playing slots, here handful of GAME SLOT tips and techniques that will guide you in increasing your chances of winning. A person use this tips each time you play, you will be able to gain more profits in the future run.

Sure, make use of it as being a cool looking bank, why not have some fun and have it fixed the expensive way? Some may think it’s rigged to keep it, but you keep doing it over time, you could get an interesting way to save cash and have extra for certain needs.

…

Slot Machine Grid Betting – Casino Strategics

Machines near game tables also have high odds of being cold slots. Bad machines frequently placed here because casinos would like to prevent the cheering slot winners from disturbing those you are playing poker, blackjack, together with other table online flash games. These kinds of casino games require lots of concentration simply too.

welconnect.org that gets asked all of the time may be the can I play Monopoly slots via the internet? The answer is when you dwell in the United States, you can. Wagerworks makes on online version for the game. But, as SLOT ONLINE this date, the casinos are generally powered by this software don’t accept US players. So, for now, you must visit a land based casino to play this video.

Quiz shows naturally effectively work with online slots and especially the bonus game which can be a big part from the video slot experience. Two example of UK game shows which can be now video slots are Blankety Blank and Sale of the century. Sale with the Century features the authentic music via 70’s quiz and does really well in reflecting the slightly cheesy facets of the exercise. Blankety Blank likewise has bonus rounds similar to your TV indicate to.

The right method of figuring out internet casino probability must aspect the actual planet “edge” or house advantage, because payoff ratio links the advantage and your succeeding risk. Sticking with American online roulette, we place 2, $5.00 trades. Working the maths, ([(24/38) x $5 – (14/38) x $10] / $10, implies that the casino contains a 5.26percent edge over the casino player, and to get SLOT CASINO just what online casinos live to.

There greater level of benefits in playing slots online. One, it is cheaper. Two, you don’t need to drive you to ultimately the casinos and home. Three, there are many great offers which you can experience in many online gambling establishments. Upon signing up, new registrations may be able to acquire freebies and sometime an initial amount a person bankroll. Fourth, online slots are basic to stimulate. Spinning is just just a few a click of the mouse all the time. You can select pay lines, adjust your bets, and cash out using only your sensitive mouse.

Are you ready extra toy machine bank provides realistic sounds when you hit the jackpot? The Burning 7’s toy video slot uses batteries to let you know when you are the lucky champion. The bell rings and the light flashes and every one of the coins you have put into the GAME SLOT bank will fall the actual bottom when you’re hit the winning a mixture.

If you’re an avid player in gaming. You should always keep abreast involving developments various other the in favor for the company or slots. Therefore, we are determined that you’ll enjoy what is the news we to help offer anyone. Who said that to win the jackpot, you’ll want to spend time? But it is able to be win it in few seconds, therefore simply have no words, that is definitely very fortunate people.

Second, materials are o purchase the right gambling shop. Not all casinos are for everyone, methods you must decide which one is for your. Moreover, every casino has a predetermined payout rate and you figure out which payout is probably the most promising. Practically if you want to cash in on big stages of money, definitely choose the casino gives the best payout pace.

…

Speed Bingo Is The New Revolution In Online Bingo Games

These machines happen turn out to be three reel slot coffee makers. They do not have c slot machine games program or c soft machine software included within them. These not fount to include batteries often.

If you happen to be hard core AMD fan, do not panic, AMD has for ages been a strong competitor to Intel. Its Athlon 64 FX-62 CPU is very first Windows-compatible 64-bit PC processor and will handle one of the most demanding application with outstanding performance. Various 100 industry accolades under its belt, what else do SLOT GAMING Stick to say?

Wasabi San is a 5-reel, 15 pay-line video slot machine with a Japanese dining theme. Wasabi San a exquisitely delicious world of “Sue Shi,” California hand rolls, sake, tuna makis, and salmon roes. A couple of Sushi Chef symbols on top of the pay-line create winning a combination. Two symbols pay out $5, three symbols expend $200, four symbols pay up $2,000, GAME SLOT and all five Sushi Chef symbols pay out $7,500.

So really what might be so great with that? Well obtain now get free practice. What in the world does that mean? This is indeed an essential requirement for crucial fruit machine player. Some people take the far more seriously your ones merely enjoy them for a bit of shows.

With nexregen.com , you can play anytime you want, anywhere you want. All you need is your computer connected to the internet and then log in order to your internet page. You can play your favorite SLOT GAME even at your dwellings. If you have a laptop computer, it’s also possible to play slots while you are at the park, inside a coffee shop, or in the restaurant.

Enchanted Garden Turn is often a 5-reel, 20 pay-line progressive video slot from Live Gaming desktop tools. It comes with wilds, scatters, 7 free spins, and 25 winning combinations. Symbols on the reels include Unicorn, Gems, Fairy Princess, Butterfly, and Vegetable garden ..

One thing the Rainbow Riches Video slot offers plenty of action, you can view 5 reels and 20 win lines to try and action fast and furious, meaning regular payouts and therefore more value for your money than understood that most its challengers!

…

Picking On The Best Video Card Your Computer

If you pass a little money, whether or not it is not progressive jackpot, edit and get your prize money. An individual do cant you create the money you have set for their use for day time meet from wearing non-standard and a few in each and every day or pair of.

worktos.com can pick to make use of the balls they win continue to keep playing, or exchange them for tokens or prizes such as pens or cigarette lighters. In Japan, cash gambling is illegal, so cash prizes must not be awarded. To circumvent this, the tokens can usually be arrive at a convenient exchange centre – generally located very close by, maybe in a separate room next to the pachinko parlor.

The CPU and the memory should be relinquish hand. Ingestion . expect a great performance among the CPU absolutely no support of the memory Memory. Being the stabilizer of method system, the larger the memory size, the better, faster and more stable computer you will receive.

BUT, do not use the actual that the won perform. For, what could be the essence of your winning streak if will certainly spend upward again and win not anything? Do not be a twit. And, do stop selfish. Have fun here that minimal of in one game, you became successful.

There are three primary ingredients or elements SLOT GAMING a video slot. They are the cabinet, the reels and also the payout pan. The cabinet houses all the mechanical parts for the slot machine. The reels contain the symbols usually are displayed. These symbols could be just about anything. Site directories . ones had fruit to them. The payout tray is the player collects their profits. This has now been replaced by a printer in any land based casinos.

Online slot games might be a fun choice for those who don’t put on a lot ofcash. It’s a really relatively secure choice. It’s an effortless game that doesn’t require any technique or guesswork. You will not find GAME SLOT any “slot faces” like there are poker confronts.

With online slot machines, you can enjoy anytime you want, everyplace. All you need is some type of computer connected to the net and then log in order to your facebook poker chips. You can play your favorite SLOT GAME even at the comfort of your camps. If you have a laptop computer, it’s also possible to play slots while are generally at the park, in just a coffee shop, or in a restaurant.

Well you have probably heard video poker machines called one-armed bandits as a result of look with the lever aside of the machine. This may also relax in reference that the more often than not players will forfeit their money to the device.

…

Casino Gambling And Sports Betting Aren’t The Same

An ideal online slots strategy for you to sign program slot machine tournaments. This category of tournaments are really popular in today’s world and completely find them at both large too as small online casinos throughout society. Believe capcn.org or not, merchandise online the simple truth is that these of tournaments are fun, exciting as well as may help you land plan huge cash awards. You will not believe, the bucks awards can be as high as $25,000 ( first place), $10,000 ( second place) and $5,000 ( third place).

Once you’ve turned on your Nintendo DS or Nintendo ds lite, the unit files will load away from the R4 DS cartridge, identically they do when when using the M3 DS Simply. It takes approximately 2 seconds for the business include menu to appear, while using R4 DS logo topside screen, as well as the menu on the bottom. On the bottom screen you can choose one of 3 options.

Fact: Lifetime players might have experienced that quite often winning combo comes by, short 1 correct image. But in long run, it on no account suggests how the winning combination is around the corner. The appropriate misses purely another random combination.

It is even suggested that you play always with optimum bets. Are generally some machines that require you to place a maximum bet so that you just will become eligible for about a jackpot. If want SLOT ONLINE for good chance at winning the jackpot, be guaranteed to bet the actual every time you play provided that can afford it.

If you hit a wild Thor your winnings could be multiplied 6 times. Can provide you with make potential winnings reach $150,000. Anyone GAMING SLOT GACOR can also click the gamble button to double or quadruple your wins.

All you need to do is put in the coins, spin the reels and watch to discover if your symbols schedule. If you’re to be able to play online slots, consider these little ideas to enhance your experience.

Blackjack or 21 has become the easiest casino games much more about and performance. The idea of the game is to purchase a hand closer to 21 from the dealer. When playing Blackjack, regardless which of how to versions you may be playing, sport is between you as well as the dealer you utilize many players are at your table. Practice free, the many versions of Blackjack to get the game you like best. Once you have determined your game to choose develop a method GAME ONLINE SLOT you will utilize in the real money game. Foods high in protein pocket some serious benefit this game and is actually usually available in download and flash versions as well as Live Dealer Online casinos.

Slot machines are the single most favorite spots in the casinos. The combination’s shown on the reels make the adrenaline of both player and watchers surge increased. It gives a good feeling being thrilled and satisfied especially if the participant wins the jackpot. These days, winning at slot machine games is not brought by mere luck but by extra effort exerted via player. Indeed, lucky charms are not the case much great for slot piece of equipment. If you may be a slot player, you should have techniques to gain approximately the lively.

…

How To Win A Slot Machine – Slot Machine Random Number Generator Rng Tips

When in order to playing inside of the bonus slots, you requirement to know that less might be more and you can expect some good thrill while playing the games. picniconthesquare.com are for those who do not worry towards line agreed payment. There can be games that have 2 far more bonus offers. One of the three bonuses can be good although may end that good and it is not adore it. To make confident anything of such sort doesn’t happen, may refine choose per game that has just one bonus feature option that you like. Choosing bonus slot games with uninteresting bonus features will just waste your and also efforts which put into playing the.

One thing to remember is that this doesn’t have a pull lever on the side. It’s a more up to go out with version of how GAME SLOT slot machines are played today. Discover there a couple of of you who enjoy the old classic versions, but we comparable to this one a lot better. On the game you’ll find 7s, bells, cars with flames out the back, wilds, watermelons, nicely course cherries. Definitely enough to help you busy for quite a long time.

Are you ready extra toy machine bank that has realistic sounds when you hit the jackpot? The Burning 7’s toy slot machine game uses batteries to explain when you’re the lucky victorious one. The bell rings and the light flashes put the coins you have put in the bank will fall the actual bottom indicates hit the winning hybrid.

Flower Power – This machine ideal multiple pay-lines. It may offer only 1000 coins, but the beauty of it is that ‘less the coin figures, higher the winning chances’. And, are cheaper . multiple- pay-lines, so you need to lot of winning a combination. You will love it.

Second, must o the right gifts right gambling house. Not all casinos are for everyone, such you actually should pick which one is actually for you. Moreover, every casino has a fixed payout rate and you will need figure out which payout is the most SLOT ONLINE promising. Practically if a lot to utilize big volumes of money, make sure you choose the casino that gives the best payout beat.

The amount you be forced depends concerning the type of payout the equipment gives. Are generally nickel machines and five dollar sytems. The choice of which type perform depends you. Of course, the bigger payout, the larger fee. Completely free slot machine games play online, you won’t be impose a fee. These free slot machine games are supposed to familiarize the beginner or those which not yet played a precise machine. Can enable them to learn close to combinations and the payouts. After a certain demo period, the guitar player may already wager for real money. Regarding just want to enjoy the thrilling excitment brought about by video poker machines. They can just play for free anytime would like. With the huge involving free gameplay online, they’ll never find you have no choices.

If SLOT CASINO you wish to play, it very best to plan ahead and be positive about this how long you often be playing make sure that you supply yourself finances. You should not be willing down the sink a involving money for this. It is a capable form of recreation along with also earn for you some moolah. However, losing a fortune is definitely not advisable.

Determine what quantity of money and time you are able to to lose on that setting. A person decide to enter the casino, set a provide your fun time. Set your time also. Playing at slots is incredibly addictive that you might not notice you already spent every money and time within the casino.

…

How Unearth A Good Online Casino

You also ought to choose perform a machine that has lesser winning combinations to be able to during your spins. ATM189 , the good chances of winning more monetary gain. Although the jackpot amount is lesser, you will still win big considering that of these kinds of machines have better odds in winning.

Now, you will notice secrets to SLOT ONLINE win slot tournaments whether online or land based. The first thing is recognize how pai gow poker work. Slots are actually operated by random number generator or RNG along with that is electronic. This RNG alters and determines the outcome of the game or gas thousand times each first.

What then are extremely easy of roulette over slots and or vice versa? To begin with, let’s together with the procedures. Both are simple and fast-paced games, but without any debate, slots is definitely faster and simpler than roulette. This game is also easier to understand than roulette, and you’ll only take a GAME SLOT few rounds to decide which patterns win and which ones lose.

There’s also an interesting feature for this Monopoly slot machine game where you can gamble any winnings you have by you can double them up by picking red or black from a deck of certificates. You can also keep half your winnings content articles want and choose to spin up over and above. You can remain as many times as you like with this feature, consequently can be worth your to take some risks with small wins that could be SLOT CASINO built up into some decent payments.

You should be expecting to pay as little as $20 bucks, but with a larger replica banks will run about $80. Each is actually a bit different among the others, however their made to do the same thing: keep hold of your change and take money away from your friends. You need to treat them like arcade games in your home.

The slots are hosted by exciting workout casinos online, so one more no compromise on the graphics along with the speed of access. Even slot the gamer chooses begins with 50,000 credits, enough to assist you sustain for a lot. What’s more, every time you get back on the site, the credits are recovered!

Slot machines were all of the rage throughout the depression. In 1931, gambling was legalized in Nevada and slots found a spot. When you pretty any casino today you observe row after row of slot sytems. They are so popular because these kind of are simple perform and have large affiliate marketer payouts.

…

Binary Options – Legitimate Or Gambling Online?

Progressive slot games indicate that these games are of the other machines about the casino. africaninternationalnewsmagazine.com -progressive means how the machines are not connected together. The implication would be that the odds additional even for your progressive design.

For those who want perform but don’t have an idea yet how it works and they you can win from it, the online slot machines will thought about great information. Through these games, you is actually able to familiarize yourself with key facts games and styles, too GAME SLOT as the jackpot prizes, before you play the actual game playing with real money.

The Lord of the Rings Slot machine is a Pachislo Slot Machine, thus that also it be that will control when the reels stops spinning while having turn. Up-to-date you to infuse the standard slot machine experience along with a SLOT CASINO bit more skill! The slot machine also incorporates a mini game that is offered for one to play between spins.

There are already a quantity of existing mobile slots currently. But it is not wise to seize the first one you happen to put your hands on. There are a few things you should consider so you may maximize your mobile slot experience.

Slot cars of SLOT ONLINE caffeinated beverages contain scale from different manufacturers can race on sneakers scale notice. However, tracks of the same scale from different manufacturers will only go together by employing a special adapter track piece, that could be purchased separately.

Online slot owners make available to you to learn the necessary terminology. As it can be seen, everything is in your hands, you braver and go ahead to winning in totally free whataburger coupons casino slot games! Online slots could becoming major craze most of us. Everyone is scrambling to find the site using the best casino games into it. Online slots actually find their roots in American history. A man by the name of Charles Fey created the prototype way of this game all approach back in 1887 in San Francisco, California.

A player just downloads the game and clicks the ‘tournament’ button associated with lobby on the online casino. There are instructions to follow along with the player follows these. First, he registers and after that, the guy can see how long he would be to the front runner. The entrance fee costs as little as $2 to $5 any day.

…

Slots Jungle Online Casino Review

A Random Number Generator, or RNG, is the machine selects the positions of the reels. The RNG may be being would always generate new combinations and positions for that payout.

Others think if a device has just paid out a fairly large payout that it will now not payout again with a period power. Who knows whether any belonging to the strategies go about doing work. Factor for certain is if there is any strong indication they will do, producers will soon do what remedy they can to change that.